| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 |

- Pfizer

- Viking Therapeutics

- VK2735

- 노보노디스크

- 경구용 glp-1

- gsbr-1290

- GLP-1 치료제

- 자가면역질환 치료제

- 제약바이오

- GLP-1

- 비만치료제

- tern-601

- danuglipron

- 바이오스터디

- Semaglutide

- Nash

- GPCR

- VKTX

- structure therapeutics

- nash/mash

- orforglipron

- CAR-T

- Mash

- il-17 inhibitor

- tirzepatide

- Novo Nordisk

- glp-1 비만

- survodutide

- glp-1 비만치료제

- lilly

- Today

- Total

제약바이오 츄롸이츄롸이

Pfizer Danuglipron; 어떻게 되려나 본문

Pfizer 경구용 GLP-1 빨리 진입했지만 꼬이고 꼬인

Lotiglipron QD / Danuglipron BID 2가지 물질 있었으나, 아래와 같은 발표와 함께 중단

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-provides-update-glp-1-ra-clinical-development

Lotiglipron의 개발 중단 이유는 drug-drug-interaction, elevated transaminase

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-announces-topline-phase-2b-results-oral-glp-1r

Danuglipron BID 중단 사유:

High rates were observed (up to 73% nausea; up to 47% vomiting; up to 25% diarrhea).

High discontinuation rates, greater than 50%, were seen across all doses compared to approximately 40% with placebo

Danuglipron은 formulation 개선으로 QD제형으로 해서 탐구 한다고 밝혔었음.

과거 이쯤되면 뭔가 업데이트를 준다고 했던 시기가 지나도 잠잠해서 몇가지 리서치 진행.

Seeking Alpha에서 보이는 Transcript들에서 'danu'를 검색

2024-01-03; 23년 4분기 실적발표:

Terence Flynn

Two for me. I guess the first one is just Comirnaty rest of world was ahead of consensus expectations this quarter. Just wondering if there were any one-time benefits in that number, if that's a fair go-forward sales level to think about through 2026, given the existing EU contract? And then the second one is, I noticed that Danuglipron wasn't mentioned in the PR or the prepared remarks. Just wondering if that once-daily PK trial completed yet and what the next steps are there?

Albert Bourla

Thank you very much. Maybe very quickly on Danuglipron, we didn't mention because we don't have anything to say more. So that's the only thing. There is a program, which is composed with a lot of experiments that we are doing now. In terms of moving it to once-a-day and we will speak only when we have data. We don't want to become now the focus again of another earnings call. But that being said, I'm moving it to Alexandre to discuss about Comirnaty in the rest of the world outside the U.S. What are the dynamics of Comirnaty?

Steve Scala

Two questions. First, on Danuglipron, I know Pfizer doesn't want to provide an update. But clearly, the company has greater insight than we do into how the once-daily version is performing in the Phase I PK trial. So I'd like to ask how would you characterize that performance so far? In the absence of any visibility, it's kind of hard for us to be confident in the outlook for this program. Second question is a new weight loss agent was added to Phase I, designated 6016. Can you tell us what the mechanism is, please?

Albert Bourla

Yes. Steve, I'm going to disappoint you because you are asking things that we have said we are not willing to disclose at this stage for multiple reasons. Clearly, on Danu, we have more information than is very normal with everything that we are doing because we're having a very complicated, as I said, multiple experiments plan right now. But because we don't have new data, we're not going to comment on that.

And on the new weight loss molecule also, we said that unfortunately, we are not going to disclose the mechanism of action. The reason is because, first of all, it's too early. We don't want to keep competition, nothing strange about that. So I'm sorry to disappoint you but there is not much to offer at this stage. Hopefully, as we said, mid-year is where we expect to have more information on that.

Operator

Next, we have David Risinger with Leerink Partners.

David Risinger

Thanks for all the updates. So I have two questions, please. First is for Dave. Could you please discuss the '24 gross margin [indiscernible] some detail. I think on the last call, you had discussed potentially a low 70% gross margin. But if you can comment on that in more detail, that would be helpful. And the second question is for Mikael. If Danuglipron once-daily does have a profile that you're looking for, would the company then conduct a Phase 2A dose ranging study to assess the efficacy and tolerability in order to design a dose to advance Phase 2B or Phase 3?

Albert Bourla

Thanks, Dave. Very quickly, Mikael, resolve Danu and then we'll go to Dave.

Mikael Dolsten

Yes, you heard Albert say that we are running a number of clinical experiments to garner insight in that molecule, and we have a second lift. Pfizer has always been open to consider different types of clinical study design. And in general, we tend to move into directly whenever data is supportive, if there is a large safety database into Phase 3 with a lead-in phase. But we have to look at each program by program. So when we have all the data, we will be able to share with you.

2024-03-04; TD Cowen 44th Annual Healthcare Conference:

David Denton

Yes. Well, keep in mind, maybe a little history lesson here for Pfizer. We had two assets in the clinic in kind of late Phase II. We now have 1 asset. We're going to -- at the end of the day, science and data is going to guide us on how we're going -- potentially could play in this marketplace. We still have 1 asset today, danuglipron, that is in the clinic today. We're working on a once-a-day formulation of that asset. And we'll have more data about that by, I'll say, midyear this year, and that will help guide us on the pathway forward. This is drug development. Drug development is not certain, and we'll see what the data shows. And then, based on that data, comprehensively, we'll figure out how we move forward.

Steve Scala

Is obesity a market in which Pfizer is determined to win. So if danuglipron is not all that you want it to be, would you pursue other means to be involved in this? Or is obesity a nice market that we participate in, but not critical.

David Denton

Well, obviously, it's a great market and just with the forecast of the size of the market. Keep in mind, we have assets that are in early-stage development in the same space as in weight management, weight loss. So again, it's a market that's attractive to us, but again, we have to make sure that we have the right assets and the data and the science behind it such that we can compete successfully in that market, and are coming out of our labs and the data that we produce will kind of give us our path forward from that perspective.

2024-03-12; Leerink Partners Global Biopharma Conference 2024:

David Risinger

Excellent. That's great. So maybe we could pivot to the vision for obesity R&D. Obviously, you're working on the potential once daily for danu, but you have other efforts as well. So if you could just provide a framework and what to watch, both with respect to when you'll have clarity on the possibility of danu once daily and then other options.

Mikael Dolsten

Yes. First of all, we feel, given our skills in cardiometabolic that this is an area we are committed to. And our presence in global primary care over a long time position us well for that. In total, we have three assets that are pure obesity in the clinic and another asset that works on muscle energetics that could also be a very interesting space. Of the three, two are GLP-1s and one is a validated mechanism for obesities through the peptide therapeutics that are used, and that's really our strategy. We use our unique skills to make oral small, convenient, scalable, small molecule. And based on principle that has been validated by injectable in this area, why do we think that's really attractive? Well, it's approaching 1 billion patients worldwide that suffer from obesity. And you have noticed it's really hard to bring manufacturing of peptides to that scale and the need to make devices doesn't make it practical for a broad population of overweight and obesity. The 1 billion is overweight and obesity, but that's really the segment that's addressable now, and the overweight often have then comorbidities, cardiovascular, renal, et cetera. And with the lead asset that did deliver really robust body weight loss up to 13% over 36 weeks, danuglipron, we are working with a set of once a day sustained release formulations that will wrap up around midyear. We promised first half of the year. And we'll be able to look at that and define next steps. We have strong skills in modified release and have brought many drugs into the market, and that makes me encouraged to believe that we can address the once a day challenge we put in front of us in a good manner, and look forward to get that data and review them and prepare for next step.

David Risinger

Excellent. So when you mentioned the three assets, obviously, one of them is danuglipron. But what are the other two?

Mikael Dolsten

The second is another GLP-1 that has some different features also in the clinic and looks encouraging when it comes to PK and dose. And the third one, we haven't released the mechanism yet. But it's one of those mechanisms that being validated by biologicals from companies that are in that space, the type of mechanism that you hear from Lilly and Novo. And we've been able, I think, by far, being the first company to make an oral version of it. So while a drug like the GLP, danuglipron is a bit ahead as it would have strong number of patients in Phase II, plus possibly a once a day that we'll discuss as we approach middle of the year, we could see that as a potential first entrant. The second drug would be a nice combination in order to build a portfolio that address different type of patients. Some patients may need to lose 10% of body weight and be in a normal spectrum, and it addresses their metabolic dysfunction. Other patients may want to have more body weight loss and may need combo agents. And you really see that, now, from the peptide companies that they play with single, double mechanism of action. And we're making progress on a variety of different mechanisms, but these are the two more advanced and more to come or a version of peptide-validated mechanism. And again, with this large population of obese patients, just in China, as an example, you have 600 million patients overweight and obese, and that's a place where an oral drug would strive. Of course, in United States, too, where you may have 150 million patients that could be qualified, it would be very hard to satisfy all of those segments with just injectable. And that's why you see us and some other companies pushing into the oral segment to be able to access that larger population.

David Risinger

Excellent. Thank you. So you've mentioned those second and third, those are both in Phase I currently.

Mikael Dolsten

The second and the third are both in Phase -- have concluded -- one of them have concluded Phase I, is now gearing up for a Phase II trial. The second one is just concluding Phase I. So it's moving pretty swiftly, that with three different assets.

David Risinger

So just to clarify. So the second GLP-1 is gearing up for Phase II.

Mikael Dolsten

Yes.

David Risinger

And then the one that you haven't disclosed the mechanism for, that's wrapping up Phase I.

Mikael Dolsten

No. It's the one that -- the novel mechanism is already in planning for the Phase II study.

David Risinger

Okay. The other in reverse.

Mikael Dolsten

It went up and it looks like a low dose, well behaving, typical beautiful Pfizer oral drug. And the other GLP-1 beyond danuglipron is just concluding Phase I, finalizing the cohort. But whether and how we would develop that, of course, depends on danuglipron. If we have QD on that, we may be happy with that and not need the second one. On the other hand, we have seen that the GLP-1 assets play a role in metabolic disease. They may play a role in certain addiction diseases. They may play a role in certain neurological conditions. So we also thought it could be to our advantage to have more than one GLP and be able to combine them with other oral drugs that I spoke about.

David Risinger

Excellent. Yes?

Unidentified Analyst

The second GLP-1 that you have finished Phase I and are in Phase II, how is that?

David Risinger

No. He mentioned it's the new mechanism that is --

Unidentified Analyst

The second one he said it finished Phase I.

Mikael Dolsten

We are wrapping up Phase I, I said. We haven't --

Unidentified Analyst

That's the third one, you're wrapping up Phase I, I mean, that's the mechanism you won't have. But the second GLP that you told us that indicate Phase I and you --

Mikael Dolsten

We are concluding Phase I. So we haven't --

Unidentified Analyst

What's the difference from danuglipron? How is that different?

Mikael Dolsten

Well you know every --

David Risinger

Yes. For those -- there might be some on the webcast. So the question is for the second phase -- for the second GLP-1 beyond danuglipron that's wrapping up Phase I, how is it different?

Mikael Dolsten

As I said, danuglipron is the lead drug for us because we have treated more than 1,500 patients, so we know it's safe. And our focus is to get to once a day. The second one, I would, at this point, see more, like you see in all the obesity companies, they are developing multiple drugs for this area because it will be different needs for different type of patients. And this, we may not need a second one at all and decide that we're all fine. There are areas like addiction, the various craving conditions outside body weight, there has been intriguing reports on neurological disease, some of the companies running trials in Parkinson and Alzheimer. So it gives us just one more card if ever needed. I would focus for now on danuglipron and --

Unidentified Analyst

Let's focus on danuglipron. You're finishing up your extended release study. We will have the results by midyear. What about safety? Danu's biggest problem was nausea, vomiting. It was very strong, very much. Is that improving with the extended release, question one, and tolerability.

Mikael Dolsten

Yes. The safety is where you have issues that could stop the drug. Tolerability is how well it affects the patient.

Unidentified Analyst

Is that tolerability improving for danu in extended release? That's the first question. Second question, your weight loss is still 15% with danu. And others are coming out with 20%. Like orforglipron would be 20, and others are even higher. While these are coming out with once a day, why will anybody use danu long term?

David Risinger

Yes. So let me repeat the question. So the question is twofold. First, how is the extended release going to impact the tolerability because there were tolerability issues in the danu data? And then second, if it generates 15% weight loss, will it be competitive with others, orforglipron and potentially combos that could drive greater weight loss?

Mikael Dolsten

First of all, we only develop drugs beyond, of course, the early clinical development that we believe can be differentiated for patient and satisfied needs that are unique for patients, number one. Number two is that if you look at, for example, data on semaglutide, which is more modest in weight loss maybe than Mounjaro at certain doses, it had dramatic effect on cardiovascular outcome in renal. So there is a balance between how much weight you lost -- lose and your general health. Too much weight loss leads to muscle impairment. So I'm not sure we should be so simple and think more is always better. We need to look at the holistic taking care of patients, and GLP have effects that are beneficial beyond weight loss. So I wouldn't lock myself into a box and think about only that. And when it comes to tolerability, please remember, we had the first titration in that trial in order to reach and really answer the question, can an oral molecule give 10% or more weight loss. That was our goal. And, yes, it could. But it was forced titration. If you look at some of the other studies where they go from forced to allowing physicians and patients to more individualized titration, it improves dramatically tolerability. So there are many ways that you can go from Phase II and onwards and improve tolerability. And if you really look at the danu data compared to Altimmune data and the BI data on the GLP glucagon, they are all in the same ballpark of nausea, vomiting, diarrhea. We just chose again it's a lot how you decide in a Phase II to generate data fast or have extensive durations of treatment up and down. So I wouldn't focus on that. It's a safe, efficacious drug. Can we get it once a day? We put all data together and have the opportunity to discuss our next steps around media. Appreciate your interest, but I want to make sure also David can answer -- ask me more question and just to visit. It's one of our many interesting opportunities.

2024-05-01; 24년 1분기 실적발표:

Terence Flynn

Maybe just a two part from me. Just wondering if you can comment at all about any potential impact in 2025 from the Part D redesign. We've heard a couple of other companies already comment here. And then one on the pipeline, can you give us any update on danuglipron and your plans more broadly in obesity? Thank you.

Albert Bourla

Yes. Thank you. Clearly, danuglipron is in the interest. Let me take that one to clear the way. It's not new. We don't have news on Danuglipron. Everything is as we had discussed before. So, we are waiting around mid-year to get the totality of the data that relates to the once-a-day formulation. And then based on the data and everything else, we will make decisions for future plans. So, we'll speak about them when we have more to say. However, now, let's go to Amir about the Part D redesign in 2025. Do you expect that?

Steve Scala

I have two questions. In the Pfizer mRNA flu vaccine efficacy trial, was superior efficacy versus approved flu vaccine shown in the 65-plus cohort? This data was to have been presented last year but I don't believe we've ever gotten an update. And then, secondly, your interest in obesity more broadly. So the outlook for danuglipron is not good. Bolt-ons don't look likely, and this is just one very simple data point. There are post things on pfizer.com for obesity clinical lead physician suggesting something is moving forward. So what exactly is moving forward in obesity at Pfizer? Thank you.

Albert Bourla

Yes. On the obesity end, Mikael also can comment, of course, together with the mRNA flu vaccine. But I said multiple times that first of all, metabolic is an area that we have traditionally very big strength in terms of research. And this is an area that we have the right to win. So we are strong and to keep investing in the whole area because we have the infrastructure. And obesity is a very big part of it, given the magnitude of the market. So we will be very active in the obesity with current mechanism of actions and new mechanisms of actions.

We said repeatedly that we had 3 agents right now in the clinic, and we have multiple that are pre-clinical that we are progressing. But we don't have anything to say per se right now because on that you are waiting, some other data and for the other ones, it's too early to speak about them. So that's why we are not commenting much of that. And we will, let's say, continue being very active in the obesity space and one we're in now. Now what about the mRNA flu vaccine and anything you want to add also to the obesity line?

2024-06-10; Goldman Sachs 45th Annual Global Healthcare Conference:

Chris Shibutani

Okay. Let's touch on some other areas, metabolic disease, obesity, very logical from a Pfizer standpoint, the [house of] (ph) LIPITOR going back a decade ago, a difficult journey with the pipeline assets that you've had at this point. What is your appetite for still being in there?

Albert Bourla

Very high. The reasons are very, very simple. One, the market is real and is big. The classes that we start seeing, they have some disadvantages, but they look very good so far, right? The GLP-1s, that is the first class that is coming. And it's just scratching the surface of what we will see in obesity. And Pfizer, as you said, has a very long tradition in metabolic diseases and in, of course, primary care commercialization. So it is an area that we are investing and we will continue investing and will be part of it. Now we had a first choice that unfortunately failed back in the day, I mean, a year from now -- a year ago. That was the [lotiglipron] (ph) failed because it had safety issues with liver enzyme elevations, which happens in those -- in drug discovery. So we killed it. Things would be extremely different for us if we didn't have those liver enzymes because we would be the first one probably to come with an oral obesity or together with Lilly at worst, even that we didn't have that setback. Then...

Chris Shibutani

You have an asset in the clinic right now, Phase I, but -- are you comfortable with what you actually have in-house that's currently in the clinic? There's a little bit of a time rate here versus our -- how acutely are you paying attention to what's happening around because there are plenty of small companies that are popping up with demonstrating some data that looks like they could go to the next level. So…

Albert Bourla

Absolutely. And we are looking all of them, and we are having also our own efforts. What we have in hand in the clinic right now, there are three different molecules as we have said. One of them is danuglipron, that we presented data, and then we said that we are going to, first, wait to see if we can convert that once a day and we said mid of the year. So mid of the year is June, July, that's basically the time frame that we should be having data on that. So we are waiting to see -- hopefully will come on time. Then we had two other ones that we haven't disclosed the mechanism, but they are in the clinic right now. And we have a lot in the pipeline. Also, I want to say that the injectables are the ones that are having most imminent competition, right, from everyone who has something presented so far, that is coming by year '26, '27, it is injectable. Orals, there's only Lilly right now and then us and then AstraZeneca. But I think we have at least two years difference, it's one of us. So us being in the middle, AstraZeneca been two years later than us and if we do [danu] (ph). And then Lilly been two years earlier than [danu] (ph) you if they are successful. All of that is if.

2024-07-30; 24년 2분기 실적발표:

I will review several recent pipeline highlights, starting with obesity. Earlier this month, we announced our plans to move forward with development of danuglipron, our oral GLP-1 receptor agonist that is the most advanced candidate in our robust clinical and preclinical obesity pipeline.

In previously reported results from the Phase 2b study in obesity, danuglipron demonstrated what we believe is good efficacy in its twice-daily formulation. For tolerability, we previously reported the maximum rate of GI adverse events across all doses investigated. Looking at individual dose levels in our Phase 2b study, however, we observed tolerability profiles that are competitive for the class. Our efforts are now focused on developing the once-daily formulation essential to delivering a competitive oral product.

We were encouraged by a pharmacokinetic study evaluating multiple modified release technologies and formulations. This strengthened our confidence in potentially delivering a competitive once-daily pill at dose levels expected to be efficacious.

We plan to conduct dose optimization studies in the second half of the year that are intended to inform our registration enabling studies.

Louise Chen

Hi, thanks for taking my questions. So I wanted to ask you on danuglipron, when do you expect to see the actual efficacy data and if this product moves forward as anticipated, how hard would it be for you to manufacture?

Albert Bourla

Mikael, you want to address it very quickly.

Mikael Dolsten

Yes. We are, as Albert said in the oral remarks, doing the dose optimization for PK and formulation to select potential doses for pending data progression to Phase 3 and we expect to share that first quarter.

Dave Risinger

Yes, thanks very much. And I guess I just wanted to start off by saying congratulations and best of luck to you, Mikael. So my questions are, first, could you please comment on your expectations for Phase 1 obesity candidates beyond once-daily danuglipron, including disclosures to watch over the next several months?

And then second, Dave, could you just contextualize the $1.5 billion in COGS reductions relative to the current annual run rate of about $15 billion? It seems like you're going to cut 10%. But how should we think about net reduction i.e., net COGS declines over the next three years? Thanks so much.

Albert Bourla

Yes. Mikael, why don't you give a little bit on the obesity candidates other than danu?

Mikael Dolsten

Yes Yes. As you heard from Albert, danu is the more advanced drug with a large tolerability, safety and efficacy experience. As always, in our projects, we have additional drugs in the same class. It's in Phase 1, performing as expected. We have another mechanism of action that would combine with Oral GLP [ph] such as danu later in development of life cycle. And we have other mechanisms to protect part in kidney that could also be part of an internal medicine, larger cardiometabolic franchise. Thank you.

Carter Gould

Good morning. Thank you for taking the question. I guess first one, just a clarification. I guess when we think about the PK danuglipron data, the top line, on a month ago, are we going to see any of that data prior to the dose optimization data reading out early next year? And then as we think about timelines for danuglipron, some of your European peers have talked about potentially moving faster. And I think some of the timelines that are generally thrown out there, including potentially reaching market as early as 2028. Did Pfizer have sort of similar plans or think such plans would be feasible for danuglipron? Any color on that front would be helpful. Thank you.

Albert Bourla

Mikael?

Mikael Dolsten

Yes, for your questions, we’ll likely present a comprehensive data set on PK after collecting all the data from the two studies, but we are looking into what’s the best way to sharing it timely. We have some of the most aggressive timelines when we agree a protocol with regulatory agency and pending data. And as Albert has said, if that becomes the case that we move forward pending data, you can bet that like every Pfizer program, it will be very fast.

Chris Schott

Great. Just two questions for me. Just coming back to danu again. I guess just bigger picture, do you expect the once-daily formulation will have an improved tolerability profile versus the twice daily? And maybe part of it as we think about the additional data you’re getting, will you get additional efficacy or tolerability data from these ongoing studies? Or is it really just PK, just as you’re trying to make a decision here. I just want to try to better understand what you’re going to have available to consider?

And then the second question I had was just on RSV. It sounds like some encouraging contracting updates. But can you just elaborate a bit more on the market as a whole? Is this a market you expect to grow in the U.S. this year is on one hand I’m balancing more visibility on who should be targeted and covered post ACIP.

But at the same time there's no revax recommendation yet. And there could be maybe some challenges for pharmacies trying to figure out who's high risk and who's not in that 60 to 74-year old population. So just like balance those two together, do you expect the market as a whole is growing this year? Thank you.

Dave Denton

Chris. Given that, for the interest of time let me tell you about Daniel. We have said it multiple times that is going to be PK data right now. We have done with Daniel 1,400 pace, so we feel very comfortable about the profile, we know the product. Right now the question is if we have a formulation that will allow us to take this product into Phase 3 registration enabling studies. We made an announcement because we feel that what we saw from the first round of testing multiple formulations, we felt encouraged that we have several that can deliver and one, but it was the preferred one and it is the one, but because it was the best of all, and now we are going to test it.

Also we can speculate if tolerability will be better or not because of once a day compares to twice a day because we don't have the data. But as whis [ph], I said in my prepared remarks for DANU, the profile that the DANU right now has based on the 1400 patients that we have seen is very competitive both on tolerability and efficacy. With whatever we have seen from others in the oral space so far. And in terms of timing, right now with everything we know we are the only one with 2b data on an oral GLP-1 after, of course, Lilly. So right now for everything we know, we should be the second after Lilly if DANU progressed into registration enabling studies.

2024-10-29; 24년 3분기 실적발표:

We remain on track with our dose optimization studies for danuglipron, our oral GLP-1 receptor agonist candidate and look forward to discussing more about this in early 2025. In our broader obesity portfolio, we continue to advance our early-stage candidates, including our oral small module GIPR antagonist, which is advancing to Phase II in 2024 this year. And in additional, all once daily oral GLP-1 receptor agonist in Phase I.

Chris Shibutani

I wanted to ask questions about the pipeline, particularly with regard to obesity, where we appreciate the additional insights into what you have in the clinic. Albert, you previously said that you believe that Pfizer could be the #2 company on the market with an oral. That would imply that danuglipron is the lead asset there, however, you do have 2 additional assets that we find intriguing at a GP-1 oral that is in Phase I that is once a day, but would clearly be behind. And then now an oral GIP antagonist, which I think is a source of debate. Can you frame what your strategy is, how important it is to be second to market versus perhaps having a differentiated approach with these 2 assets?

Albert Bourla

Look, I will ask Mikael to comment because there is a lot of activities going on right now, all that. But my general comment is that, as I have said, if Daniel moves fast based on what we know right now, we should be the second oral into the market, provided that the first one will be successful and the other ones will not come before us. But so far, this is what the situation looks like.

The market is very, very large. And there is a significant need for oral solutions. We know that. So there is no doubt that if successful, we will have our decent market share of oral. But the important thing it is that obesity market is developing, let's say, nicely also in terms of science, and we are exploring several other opportunities right now.

The two that we have mentioned in the clinic, Mikael Michael can speak a little bit more, both about the danu and the other two, Mikael.

Mikael Dolsten

Thank you, Albert. Yes, as you heard in Albert’s remarks before the meeting, we continue to execute on our danuglipron plan, which includes a once-a-day profile with a modified release type of system. And we do believe that once a day with modified release could have some really special features and bringing that as a second oral would help really to have a strong foot into that market, in the same way, we have seen injectable being split etweenn 2 different products.

I don’t expect that the various oral will, in the end, differ that much in the GLP-1 class. So that’s why we were keen also to move a GIFR, which could add better tolerability and more efficacy. And we’re right now, initiating Phase II studies on the backbone of [indiscernible] engines. And these are our 2 more advanced bets, plus we always like to bring in this huge segment in drives and have more options as we advance. And you’ve heard there are so many applications for GLP-1s, and that’s why we have a second once-a-day again.

Geoff Meacham

Thanks so much for the question. Just had a couple of quick ones. Mikael, another one on obesity. And I know you've added assets outside of danuglipron and I appreciate that it's early. I want to ask you, what does success look like on efficacy just given the bar today?

And then strategically, how does Pfizer view orals versus longer-acting injectables when you think about the investments Pfizer is making in this category?

And then real quick, Albert, on the IRA. Obviously, it seems here to stay. But when you think about the potential for a new administration, what would Pfizer like to see obviously beyond closing the gap between orals and biologics on exclusivity?

Albert Bourla

Mikael?

Mikael Dolsten

For orals, to keep it very [indiscernible], I think you have a number of things that could be advantageous. One is, of course, the combined [indiscernible] with all other drugs that are involved in [indiscernible] metabolic disease to give long outcomes.

And what you're looking for I would say is 10% to 20% order weight, the lower range of the first GLP. The upper range is where you can see oral combinations edge towards. And that's very much similar to what you can see with the peptide.

So I can very broad with a lower and an aspirational range, the lower for more single agents that will edge above that and combi agents that can aspire to go above 15 and edge above that.

2024-11-13; UBS Global Healthcare Conference:

Aamir Malik

Obviously, keen to see as many are, on how DANU progresses in obesity. We've selected what we believe is the right formulation for the once-daily dose and we're in dose optimization studies right now. So those are a handful of things that I'm excited about.

2024-11-22; Jefferies London Healthcare Conference:

Akash Tewari

Understood. So we'll hop around here because there's a lot to cover. I think the biggest catalyst that's coming up, I think, for Pfizer near term is on obesity. You're going to have an update in Q1 '25. You guys owe us a publication on that Phase 2b danuglipron data, and I'm sure we'll have that shortly. But maybe, Andrew, if -- we don't have that data right now, but if we were to see that data, what makes your team confident that there's going to be a competitive profile that a QD formulation can really deliver that can really hold up versus your peers like Lilly, which should be first on the market?

Andrew Baum

Sure. Well, thank you for the question, and thank you for hosting. The data that you'll see from the IIb is a BID formulation, which you're aware. And so it will talk to that formulation, which will show a series of doses, and it will show the weight loss together with the tolerability for each of the individual doses. What you will see is at a selection of very satisfactory doses, weight loss, which is competitive with the other agents that you see in clinical development.

Now there's a couple of things to bear in mind, and I think these have been already disclosed on the call. The first thing is there was no ability to step down in therapy during the trial. There was forced discontinuation. So that's very important. And the second thing was the timing of the trial, when was it initiated, which also led to the discontinuation rate.

But what I would encourage you to do is when you see the Phase 2 data, and you won't have to wait so much longer, you will see that a competitive profile will emerge. Now what we're addressing now in the dose optimization trial, which you will see together with the drug interaction trial, again, in the relatively near future, you will see the effectively bridging trial to a once-daily formulation, which provides competitive dosing. And we imagine the drug to behave very similarly, if not better, in terms of tolerability than what we saw from the BID trial.

So it's a partly mosaic approach. But I think when you step back and you look at the data, it will be pretty obvious, assuming we take the decision to go forward into Phase 3, why we're making that decision.

2025-01-13; 43rd Annual JPMorgan Healthcare Conference:

Chris Schott

Okay. Excellent. Maybe pivoting to some of the individual pipeline assets, starting with danu, I know it's a big area of focus, for folks. Just as we think about the upcoming PK studies that you'll be looking at data, what are you looking for in those studies to inform a Phase 3 decision? And maybe just characterize your overall level of excitement around danu at this point?

Albert Bourla

I'm very cautious with danu, because at the end, we have been burned. And I don't want to create neither false expectations or positive or negative. It is exactly as we have said it. In danu, we are working now on once-a-day formulation. This is about pharmacokinetics. We think we found the right ones after did a lot of experiments and now we are in dose optimization of those formulations. So, we'll have the data in few months, and then, we will see if really we can basically replicate the results that we had in Phase 2b study because danu has been tested in more than 1,600 people.

So, it's not, let's say, something that it is a few hundred people, it's a lot of people. Then, we will feel comfortable that we can go with once a day. And this is when probably, as I said, if we succeed that, we will start the Phase 3 in the second part of the year. With danu, we expect that we'll have competitive profile and probably will be second, if we stick to our timelines and if the others they don't accelerate or they don't delay, I expect that Lilly will come with an oral before us if they are successful. Then, I think will be us that will come with an oral if we are successful. And then, there are other two that will come two years intervals more or less, one from the other.

So, big opportunity is not going to be, like Mounjaro, danu, but it's going to be second oral in a market that has a lot of potentials for growth.

Chris Schott

And maybe just a last quick topic on this, just obesity more broadly, just talk about your ambitions here as you think about not just danu, but as a portfolio of assets within Pfizer?

Albert Bourla

We are all in. We are going to -- we are building our teams. We have very strong metabolic expertise in Pfizer through the years. We are recruiting experts in obesity over the last, let's say, 12, 13, 14 months so that are helping us now make better and more sound decisions. We have [indiscernible] that is following, and then, GLP-1 follow-on molecule.

So, in terms of GLP, we are in the oral space and we don't need to go outside because we have our own. I don't think that a GLP injectable will be of interest to us from the BD perspective right now, because probably it's a little bit too late, but other mechanism of action in the injectable space or in the oral, we are really looking everything into the market because I think we have the capabilities to develop it and to sell it, which is very important.

2024-02-04; 24년 3분기 실적발표:

In internal medicines, we remain on track to provide an upgrade of our dose optimization studies of danuglipron in the first quarter of this year. For ponsegromab, we expect to start a pivotal study this year in cancer caked ibuzatrelvir, our second-generation COVID-19 oral antiviral candidate, continues its Phase 3 study.

Steve Scala

Thank you so much. I have two questions. First, on the danuglipron dose optimization data, it's apparently still on track for the first quarter of this year. What is the range of possible outcomes? And is dropping this version of the compound a possibility? And what would be the next step?

Second question is, Chris Boshoff, I assume he's on the line. Under the heading of nothing is perfect, can you share with us two or three things in the Pfizer R&D portfolio or system that you think need to be fixed? New leaders usually say they want to move quicker, but sometimes they also thoroughly go through the portfolio and shed many projects. Is that also a possibility? Thank you.

Albert Bourla

Chris?

Chris Boshoff

So we start with danu. So for danu, just to be clear, we and as we stated previously, we're now targeting first quarter to have data from the ongoing dose optimization and formulation study, the PK study, and we're on track to deliver that in Q1. And we haven't seen the data yet, but obviously, that data will then determine decisions for the future of danuglipron.

On your second question, as we've recently announced, we already focused our portfolio further. We've now established four end-to-end therapeutic areas: oncology, vaccines, internal medicine and I&I. And part of that will be to focus on those opportunities that could provide the biggest value both for patients but also for Pfizer. So you will see during the coming months how we further focus and execute and accelerate those medicines, we believe, could be potential future blockbusters.

Terence Flynn

And then on danuglipron, on the dose optimization study, can you just kind of clarify how much data you're going to share later this quarter? Will we get weight loss data? Will we get tolerability data? How much data will be in the initial press release? Thank you.

Chris Boshoff

Yes. Just what we said it earlier, so in Q1, we expect the PK data, we're on target for that. Remember, this is looking at different formulations and will determine the dose selection for once-a-day tablet, for once-a-day approach for a potential taking forward into a registration strategy. Although you mentioned weight loss, weight loss is a secondary endpoint on the study. This is a smaller study. It's an in-unit study. So it may not be that reliable for weight loss from a small number of patients.

Akash Tewari

Hey, thanks so much. Just on danuglipron, it looks like you're using a bilayer immediate release and matrix technology here. But you don't actually test your bilayer formulation until the second half of your weight loss trial. Is that what your team is waiting on before you make a formal update? Or is it perhaps the Lilly Orforglipron data that's also going to factor into this decision? Thank you.

Albert Bourla

I don't think we can disclose the technology. I know that there were speculations into the marketplace, but we haven't disclosed the technology. So I'm not sure we can say much. But Chris, do you want to add anything?

Chris Boshoff

No, I don't think we need to add right now. Yes.

Chris Shibutani

Great, thank you. A quick one on the pipeline and another on business development strategy. On the pipeline, I noticed in Phase 2, you've advanced the GIP antagonist. Is that something that you'll be continuing to share data on, particularly as a monotherapy? And do you have any efforts on going to do a combination?

In terms of business development strategy, I think the vocabulary you used included a capacity of perhaps in the $10 billion to $15 billion ZIP code. And I'm curious to know what you're solving for. And I asked this in part because, historically, there had been a view of using cash to acquire $25 billion in revenue by the end of the decade. But now when we think about where we are in this decade, and we think could be solving for structurally, there seem to be approaches sourcing assets from China, for instance. Many of your competitors are doing this. Are you solving for near-term revenues, or are you looking to use other methods, including perhaps partnerships over M&A? That would be helpful. Thank you.

Albert Bourla

Yes. Let me start a little bit on the BD, on this one, you can chime in. We had -- very clear about so far, we have acquired $20 billion of [indiscernible] revenues. We are very confident that we will hit this number, very confident. So that's so far, so good on that, right? Looking forward, of course, we are looking at more strategic opportunities right now, which will enhance pipeline in areas that we would like to play rather than near-term revenues on BD. I would ask Andrew to comment, and then if you can speak, Chris, about the antagonist.

Andrew Baum

Sure. So hi Chris, nice to hear your voice. So on the BD side, Albert said the keyword, which is strategic. So everything we do will be doing through a strategic lens of building around our core competencies or building competencies in areas that maybe we have not been in previously, if that's what we decide to do.

On your point regarding China, it has not escaped our attention. Of course, the innovation from China across multiple therapeutic areas. And indeed, that was most evident with oncology seven years ago, but now it's expanding to most therapeutic areas. They're mostly fast-forwards, but I expect that will change as well. It's a scenario that we are very, very active in. We continue to have very fruitful discussions, and let's just see where we go.

Albert Bourla

We have a very strong footprint in China, and that includes not only commercial, but we have a very strong R&D footprint that they are looking at Chinese innovation because they are progressing very fast, and to identify opportunity, Chris?

Chris Boshoff

On the GIPR antagonist, this is potentially a first-in-class oral small molecule GIPR antagonist. It's currently in an ongoing Phase 2 placebo-controlled study, evaluating the GIPR antagonist in adults with obesity on the background of GLP-1 receptor agonist. If the data from the Phase 2 study are positive, we may potentially be able to develop also fixed-dose combinations, including with GLP-1, including potentially danuglipron in the future.

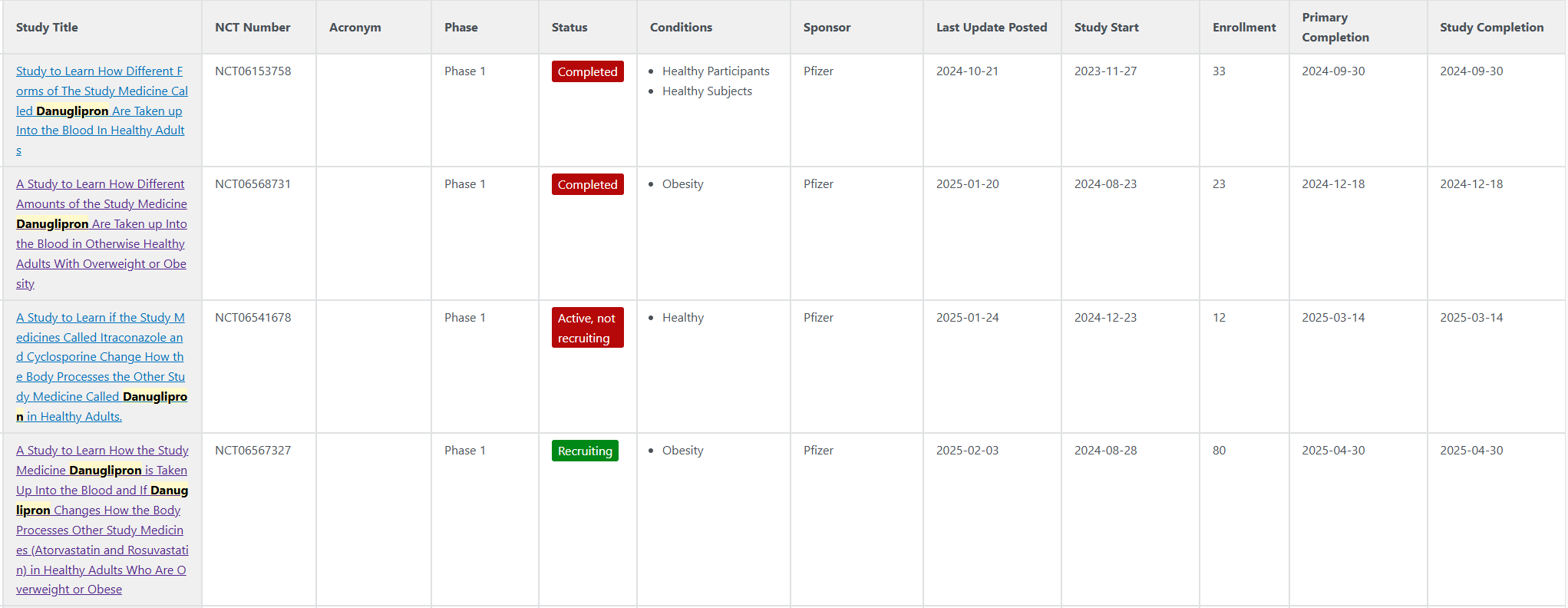

나름 최근 진행하고 있는 Danuglipron의 임상시험 목록들...

Formulation 결과에 대해 2024-07-11 Dose Optimisation 하겠다고 발표 했었음.

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-advances-development-once-daily-formulation-oral-glp

Pfizer Advances Development of Once-Daily Formulation of Oral GLP-1 Receptor Agonist Danuglipron | Pfizer

Pfizer Advances Development of Once-Daily Formulation of Oral GLP-1 Receptor Agonist Danuglipron Thursday, July 11, 2024 - 06:45am Clinical evaluation of several modified release once-daily formulations of danuglipron resulted in encouraging pharmacokineti

www.pfizer.com

그리하여 PK연구가 2024-08-23 개시되었던것 같음.

PK연구는 2024년 12월 18일에 종료된걸로 나옴.

얼마전에 진행한 24년 4분기 실적발표때 CEO가 아직 데이터를 못봤다고 함

흠... 실적발표 듣긴 했는데 뭔가 danuglipron에 대한 excitement가 없는 듯한 느낌?

25년 1분기에 PK데이터 발표한다고 하니 어떻게 나올지 한번 봐보는 것으로

뭔가 긍정적인 시그널을 봤다면 실적발표때 임상 3상 디자인 그리고 계획에 대해서 얘기했을 법도 한데;;;

조심스럽게 danuglipron 개발 중단을 예상.

'주절주절' 카테고리의 다른 글

| Pfizer - Danuglipron 개발 중단! (0) | 2025.04.14 |

|---|---|

| Novo Nordisk - CagriSema 'REDEFINE-2' 임상 결과 발표 (0) | 2025.03.11 |

| Takeaways from GLP-1 관련 Pharma (based on 4Q24 실적) (0) | 2025.02.07 |

| Sanofi R&D Day (2023-12-07) vs 4Q24 Earnings (2025-01-30) (0) | 2025.02.04 |

| Novo Nordisk CagriSema REDEFINE-1 임상 결과 발표 (0) | 2024.12.21 |